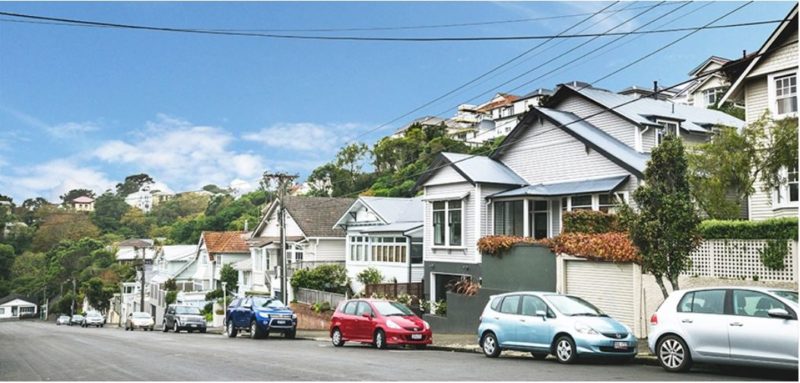

We doubt that anyone could have predicted the huge increase in residential property prices that we have witnessed in the last two years or so. Neither our learned economists nor real estate market commentators nor those of us employed in the industry could have foreseen the level of increases that are now commonplace and which are the new norm for the housing industry. Unpredictable, unbelievable, and life changing for many, but nevertheless true! The escalation of housing values has impacted various groups in differing ways and this article will endeavour to look at the overall picture from the perspective of some of the larger consumer groups.

THE AVERAGE KIWI HOMEOWNER: For most in this category, the family home is probably the biggest and most important asset that they will ever own. Their entire working life is geared towards having a home that is unencumbered by mortgage debt at retirement. Money managers and financial advisors encourage homeowners to apply any surplus funds they may have towards achieving this objective. We all follow the market to some degree and celebrate the fact that over the years prices will increase and our equity will increase with it. The trend makes us feel secure!

This scenario has changed somewhat however. Prices have gone through the roof, house values have doubled for some, and many homeowners have become millionaires overnight almost by default and simply because they have owned a house during this unpredictable era. This newfound wealth sounds great, but it is money that makes us asset rich but not necessarily cash rich. Selling your home will release this newfound capital but if buying again is on your agenda then the status quo will apply, and your new gained wealth will be locked up in real estate once again.

In summary, your equity is unlikely to have any significant impact on your immediate lifestyle other than in perhaps facilitating an upgrading of housing for you and your dependants.

FIRST HOME BUYERS: This must surely be the consumer group that has fared worst from the shortage of available property and the consequent price escalations. Tommy’s has a good deal of empathy with these people who have faced ongoing price increases, severe competition and a battle to accrue sufficient deposit funds at a time when rents have increased and Covid 19 has created much uncertainty in the workplace. We often see deposit funds being utilized for builders’ reports, valuations, legal costs, etc. and then an offer being unsuccessful in competition with several other offers on the same property.

The significant number of Kiwis returning home from overseas has added to the competition faced by first home buyers at a time when the market is dictated largely by supply failing to meet demand.

PROPERTY INVESTORS: Property investors with both small and large property ownership portfolios make up a significant portion of the available rental pool. Recent government initiatives have raised the bar in regard to minimum living standards with the introduction of the Healthy Homes Standards setting minimum standards for heating, insulation, ventilation, moisture ingress and drainage and draft stopping in rental properties. This government initiative has Tommy’s support but combined with changes to the tax laws as they effect property investors, there has been a noticeable trend showing some investors are selling and cashing in on the increased equity in their portfolios.

Tommy’s support any actions to improve the standard of rental accommodation but we are also aware that the existing undersupply of rental property could worsen if too many regulations are introduced that detract from this investment option. As with buying a property, the rental market is dictated by supply and demand and rents, which are already high, will escalate further if too many private property investors cash-up their rental holdings.

BUILDERS & DEVELOPERS: The building industry is working to capacity to improve the supply/demand ratio. There is plenty of evidence to suggest that the construction industry is doing its best to address this problem with building activity being very visible with many projects, large and small, underway. An increase in mortgage rates has been mooted for next year and this could also stifle demand as and when the cost of borrowing increases.

The construction industry has its own handbrakes to work through with shortages of tradespeople, shortages in the supply of materials due to shipping delays, and of course there is still the form filling and bureaucracy that goes hand in hand with the council building permit requirements. Modifications to the Resource Management Act can only assist as they come into effect.

APARTMENT DWELLERS: This group, of homeowners is a growing one with more and more buyers looking towards inner-city living with all its advantages. There are a number of large projects underway in and around Wellington City and buyers are prepared to wait for long-term settlement dates. Apartment dwellers often rely solely on public transport and that has no doubt been a factor in some apartment blocks being constructed without parking facilities. The lack of garaging and the suggestion that the Golden Mile may soon be vehicle free poses the question of where one parks when visiting the city. However, that is another story for another day with its own set of imponderables!

In the meantime, it is business as usual and our sales team look forward to assisting the general public in navigating the market offerings on what is still a busy and buoyant market.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal