One of the most misunderstood words in real estate circles is the word ‘freehold’; we hear it being misused almost daily! A freehold title is a ‘fee simple title’ – without doubt the best type of title possible.

So often though we hear people describing their property as being freehold (as well it may be) when in fact what they really mean is that the property is unencumbered by debt or they simply do not have a mortgage. Owning a property that is free of debt is a great objective and one that all property owners should aspire to, but it does not necessarily mean that it is a freehold property. Let us look at some of the more common types of property ownership that we encounter regularly in Wellington and elsewhere in New Zealand.

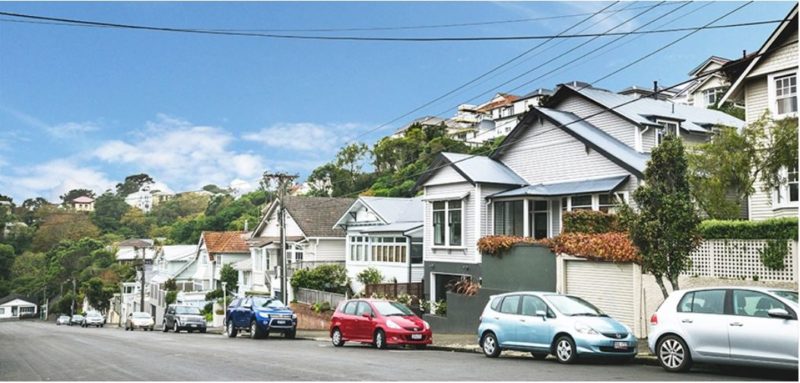

FEE SIMPLE: This is absolute ownership of the property and is described as the greatest possible estate in land. A fee simple title gives the owner/s of the property unrestricted right of use and the right to mortgage the property or to dispose of it by sale or by will or by inheritance. This is the most common form of title for stand-alone residential properties in New Zealand.

LEASEHOLD: Owners of a property on leasehold land have similar rights of enjoyment to a fee simple owner except they would usually be required to pay an annual lease fee to the owner of the land. Most ground leases are for long terms e.g. 99 years or indeed ‘in perpetuity’. The lessor or landowner may be a Harbour Authority, a Hospital Board or other similar institution or it could be a single person or persons or a partnership or company structure. The rate of ground rent is usually set for a fixed period e.g. 7, 10 or perhaps even 21, years.

CROSS LEASE: Cross lease titles were introduced in the 1960s to enable builders and developers to build more than one residence on a single section. They were often restricted to two houses, although it is not uncommon to have 6-8 houses on a cross lease flats plan and title. A cross lease tenure means that there are two or more owners of the ‘undivided whole’ of the land area. These owners lease the flat (i.e. their house or apartment) and the use of one part of the land to the other for a period of time (generally 999 years). The flats plan will show areas of land for exclusive use of each owner and areas of common ground. Driveways and access ways which are used by all owners are normally designated as common ground and all owners have a shared responsibility for the maintenance of these areas.

As an example, if you purchase a cross lease property which is in a group development of three properties you will generally acquire: –

- An undivided one-third share in the land as ‘Tenant in Common’ with the owners of the land, and

- A 999-year lease from all landowners (including yourself) for your particular flat and the right to exclusively use a designated land area.

There are restrictions on making alterations to a cross leased property and any changes to a flats plan or building may require the consent of neighbours and a new survey plan. This can be an expensive exercise and may not always receive the blessing of neighbours!

UNIT TITLE: This is now the most common form of ownership for apartment developments and for commercial multi-unit developments. The owners have all the benefits of a fee simple title but with some restrictions over matters that may have some impact on adjoining neighbours. Occupancy rules are governed by a body corporate arrangement and will cover such matters as insurance, maintenance, pets, possible restrictions on letting and other requirements that minimise interference with adjoining owners’ enjoyment of peace and quiet. Owners are required to contribute to a body corporate fund generally to cover the building’s insurance premium, upkeep of the common areas and to also provide for future maintenance.

COMPANY SHARE: In brief, rather than having individual ownership of land and buildings, a company is formed as the land and building owning entity. Buyers of apartments in this type of complex are issued with a number of shares in the company representing the proportionate value of their apartment. This type of ownership has restrictions regarding occupancy and any new owner must be approved by the company shareholders. There can also be restrictions on letting, on housing pets and other normal occupancy rights. Most lending institutions will only consider mortgage finance applications at reduced amounts as compared with a fee simple or other titled property.

All forms of property ownership have their own peculiarities and understanding title conditions can be daunting for the uninitiated. Your Tommy’s agent can offer you advice on this aspect of homeownership however our strong recommendation is for buyers to obtain legal advice and a title search before committing to buy. Having a legal overview on this important aspect of homeownership is a prudent step to take and we encourage our clients to do so.

We trust that this basic information will be of interest and value to prospective home buyers.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal

I want to leave my Fee Simple Property to my son, I’ve been looking at Joint Tenancy Ownership but am unsure as to the meaning because it has other Ownership apps also. I’m looking for something that clear and cut, either myself and my son or my son only. Also require a upfront cost to carry out this transaction. Regards Gloria