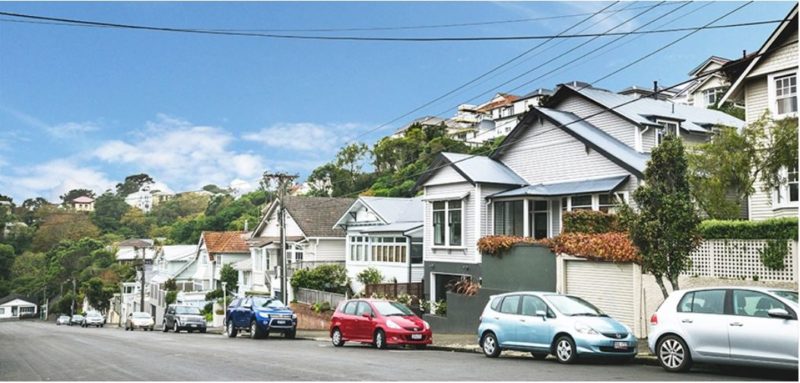

The low number of houses for sale in Wellington is keeping prices high as temperatures drop.

“The Wellington market is heading into the seasonal ‘slow down’ we always get in winter but there is still high demand,” Tommy’s Real Estate sales director Nicki Cruickshank says.

“The current listing level is the lowest I have seen in 17 years. The low supply is keeping prices up.”

So why aren’t more homeowners tempted to sell?

“Because they have to buy another one to live in usually, and it is daunting if you sell and have no choice, so it becomes a vicious circle,” Nicki says.

But she’s confident the market will right itself. “It just takes a surge in people selling, and then there will be more choice and the cycle will work.”

Ironically, now is usually the best time of the year to sell.

“Selling in winter and buying in spring is usually a win-win situation,” Nicki says.

“However, you do have to be prepared that you may not find your perfect house, so may have to rent – although nothing is more motivating to buy a house when you have sold yours!

“It usually works out, but the best advice is to ask for a long settlement with the option to bring settlement forward if you find something sooner than you think.”

The Real Estate Institute of NZ reports the total number of properties for sale in May fell 28.9 percent year-on-year, with only five weeks of stock for the Wellington region.

“Anything listed is selling really well and in a short period of time,” Nicki says, “but I believe the inventory will start to increase.

“We are experiencing a number of smaller investors starting to talk about selling their rental properties. Because of recent government changes, they can no longer claim their biggest expense, interest.

“And some properties are very difficult to meet the ‘one-size-fits-all’ healthy homes regulations.”

Nicki says a mix of buyers is driving Wellington’s market.

“We have a lot of keen buyers buying property off the plans, because it is a little easier on the brightline test and more favourable for investment.

“We still have a good number of first-home buyers looking, plus those looking to upsize and downsize.”

She says the reimposition of loan-to-value ratio limits when prices are still rising rapidly is making it even harder for first-time buyers to save for a deposit.

“The banks, though, have been implementing a tougher standard on this for some time, in anticipation that if interest rates go up, those borrowers will be able to repay their loan.

“There is no doubt first-home buyers will need some sort of extra help to get into the market, unless they are prepared to move out of town further.”

Nicki says the regions already are experiencing high demand as people spill out from the cities to seek that better ‘work life balance’.

“Areas such as the Wairarapa and Kapiti have really benefited from this, but it is happening all over the country.”

She says the biggest jump in demand locally has been on the Kapiti Coast.

“We have a number of projects in this area where new properties are more affordable.

“And with Transmission Gully eventually coming on stream, buyers are perceiving this travel as similar to any other outer suburb of Wellington.

“But inner-city apartments are also very popular, particularly in new buildings we have recently sold down in Victoria Street, and any resales are being snapped up quickly.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal