You would think fewer buyers, more listings and flatter house prices would make it easier for people to buy their first home this year.

But it could be harder than ever because of tough new lending rules that are stopping even buyers with sound credit histories from getting a mortgage. “It is difficult to predict what is going to happen to the market in 2022,” Tommy’s Sales Director Nicki Cruickshank says. “For instance, no one could have predicted in the beginning of 2020 where we would be now on house prices, some 40 odd percent above where we were then.

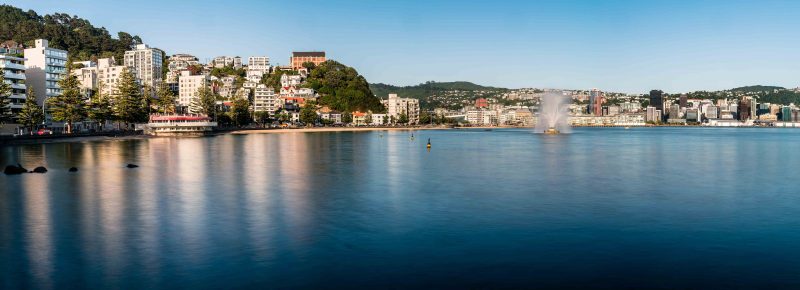

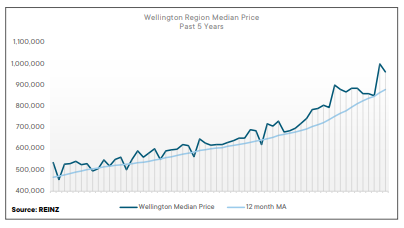

“Yet just before the lockdown it did feel like the market was about to change and flatten out!” Indeed, the latest Real Estate Institute of NZ data reveals an annual nationwide increase of 23.8 per cent in median prices, with a new record high of $925,000 in November 2021. For the 12 months ending November, Wellington’s median jumped 21.8 per cent to $962,500.

Nonetheless, Nicki feels the market is changing and expects prices to flatten, with the larger cities being impacted first. “Fewer buyers are going to be able to get a mortgage so this will dampen demand just when supply is increasing. Where in the past buyers have had to compete with 6-10 other tenders on a property, this will drop substantially.

“And those that we call ‘outlier’ buyers — those who end up paying a lot more to secure a property because they’ve kept missing out — will disappear. This will give the impression that prices have dropped, but in fact, the property will be selling more around where the market is rather than above it.” Nicki thinks lending will be the biggest issue facing buyers this year. “The banks are governed by the new Credit Contracts and Consumer Finance Act, which makes bank directors personally responsible for any bad consumer lending.

“This has literally turned pre-approvals on their head. Buyers are being scrutinised and ‘judged’ on every cent they spend before they can get a pre-approval. So if you are ‘judged’ to be spending too much on groceries, or having a subscription to Netflix, or buy a Lotto ticket – and the bank sees this as unnecessary – you will be turned down for your pre approval. “My advice? Be very careful what shows in your account the three months prior to applying for a loan.”

Nicki expects a “significant boost” to house supply in the new year. “There is a number of developments that have been sold over the past two years that will be completed soon. But the biggest increase is a change from rental stock to selling. So many landlords are exiting their rental properties – which is great for first-home buyers.

“But I do fear what this is going to do to rents in the city, where we are already seeing students having to pay upwards of $250 a room in rent. In summary, I think it is going to be an interesting year.

“But the market is what the market is, and people always need to move, whether to upsize or downsize. And if you are buying and selling in the same market, then what you perceive you may be losing, you will gain when you buy – so it all evens out in the end.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal