There is a well-known saying, ‘the only thing that is constant in life is change’. How true this is, and those who have been around for a few years will be able to recall a multitude of unforeseen changes that have occurred in their lifetime. The real estate industry and housing generally, are not exempt from change as has been evident in recent times. Changes to the way we live and work, and legislative changes offering greater consumer protection are regular and ongoing. Recent changes demanding higher standards for rental properties are an example that springs to mind.

Looking back on the articles that we’ve written, confirms our opening statement that change is inevitable. There has been constant change in the past and there will be further changes in the future!

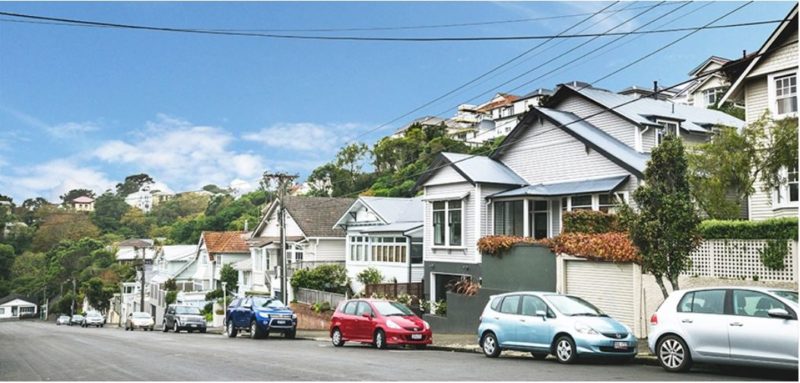

In an article written in 2007, we commented on how the cost of housing had become unaffordable for significant numbers of our population. We talked about the imbalance of supply and demand – a situation that is even more acute now. So, what have we learned since 2007; very little it seems! The imbalance of supply and demand has worsened with neither government in the intervening years doing anything meaningful to meet this predictable demand.

What we do know, is that those who made a supreme effort in and around 2007 to own their own home are reaping the benefits now with the massive price escalations that we have witnessed in recent times. Buyers who took the step into homeownership in the early 2000s are now asset rich and can claim in many cases to be the new breed of Kiwi millionaires. Residential property has been kind to many of the clients we deal with daily.

Will this be so in the future? With the real estate market being, as it is, somewhat cyclical, there is likely to be some correction to market prices in coming months/years; however we still see homeownership as being an important part of our lifestyles. Buying for the medium to long term should bring positive financial gains and there is also the often overlooked aspect of the warmth, comfort and security of owning your own home. It is difficulty to put a price on these aspects of family living.

On the subject of change, who could have predicted the low mortgage interest rates that have been on offer in recent years. Old heads in the real estate industry can recall interest rates of around 20% and we find it hard to comprehend that the rates can be as low as they currently are! A word of caution though; there is likely to be some upward movement in mortgage interest rates in the coming months so do not over commit in this highly competitive market.

The one thing that is predictable about the residential real estate market is that changes will continue to occur. Tommy’s are currently listing strongly and have a larger selection of property for sale than in recent months. Whilst the winter months are usually slow in terms of real estate activity, it would not surprise if this trend were reversed this winter as some homeowners and property investors take advantage of the high prices being paid and offer their homes for sale.

The demographics of our population are changing and will have an impact on homeownership. We have a large pool of first-home buyers competing for an opportunity to get onto the homeownership ladder. We have a large and growing number of ex-pat Kiwis returning home and seeking housing opportunities. Many of these people have enjoyed successful careers overseas and can compete financially as they launch the next stage of their careers and family lives back in their homeland.

New Zealand also has an aging population with differing housing requirements. Statisticians predict that by 2050 up to 27% of New Zealand’s population will be over 65 compared to 15% in 2016. Currently there are 83,000 people over the age of 85 and it is predicted that this number could reach as high as 383,000 by 2060. A number of these senior citizens are selling their homes and moving to retirement villages which in turn ‘frees- up’ family homes. An interim move from the family home on a large section to an inner-city apartment is another option finding favour among this large and growing population.

We are in a changing world with Covid still running rampant in some countries. Fortunately, we are relatively free of these problems, but it is still too soon to become complacent. Covid has changed the way we work, with home becoming an office for many. It has restricted our mobility particularly regarding overseas travel and it has impacted on the chain of supply for building materials, it will continue be the catalyst for other changes in our lifestyles. There will be changes in the property market with the emphasis being on increasing the number of properties being built. There will be more ‘infill housing’ and apartment construction as the construction industry gears up to cope with increasing demand.

Buying or selling, talk to Tommy’s. In a changing world we are up with the play and can offer sound advice to home buyers and sellers.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal