In our fortnightly blog posts and articles in our magazine, Tommy’s has attempted to offer worthwhile real estate news and articles of real estate interest to home buyers and sellers continuously since 2006. We trust that we have been successful in this quest and that our client base has found these articles informative. Regular readers may recall Tommy’s referring to the market from time to time as being cyclical and we think it is a word that aptly describes the market that we are working in today.

Historically, we have witnessed times when it was a buyers’ market and conversely, times when home sellers where in command of the market; a revolving cycle that we have become accustomed to and accepted as being the norm in this industry. We have of course recently experienced a period of huge price escalations which requires no further comment other than there are now a lot more millionaires in New Zealand than there were just a couple of years ago! Million-dollar properties are now the starting point for home buyers in many areas. The only thing that is constant in real estate is change, and we are currently navigating one of these phases of change.

The Covid environment has done nothing to inspire confidence, and the Covid cloud seems likely to be with us for a little while yet! We have witnessed families being isolated from one another by border restrictions, a diversity of opinion over vaccinations which has placed pressure on families and friendships, and many businesses closing their doors with a likelihood many more will follow suit. As we mentioned above, real estate values have skyrocketed but some are predicting a change as this year unfolds.

Prominent among market commentators, and a professional opinion we respect, is economist, Tony Alexander. Tony’s comments are based on his own observations and from regular contact he maintains with industry leaders throughout New Zealand. Without directly prophesying a reduction in prices, he suggests that 2022 will be a buyer’s market and gives the following reasons why:

- The fear of missing out (FOMO) has disappeared from the market. Buyer urgency has evaporated.

- Open home attendance has declined in recent months.

- Fewer people are attending auctions.

- Worries about a lack of properties for sale has diminished.

- Fewer first home buyers and investment buyers in the market.

Tommy’s shares those views and also believes that a significant factor is the substantial increase in the number of properties for sale now compared with late 2021. Mortgage funding has also tightened considerably and at the same time as we deal with these contingencies, immigration numbers have reduced during Covid.

All these factors contribute to a more sedate market, but the good news is that houses are still selling. Let’s look at the positives:

- Tommy’s City office alone has negotiated 28 sales in the first 10 days of February.

- There has been a suggestion that the mortgage market would be looked at closely by Government with a realisation that perhaps the restrictions imposed by the Credit Contract and Consumer Finance Act amendments were too rigid.

- Second tier lenders are meeting some of the mortgage demand and although they are also restricted by the Credit Contracts Act and may be more expensive, there may be more flexibility with their lending policies. We recommend that home buyers consult our associate mortgage brokers “Moneybox” for financial guidance and pre-approvals.

- The Government’s announcement that the borders would be progressively opened is a positive and must surely swell the numbers of potential home buyers as families reunite. Many would like to see this happen sooner, however.

- Although the number of properties for sale has significantly increased, there is still an imbalance nationwide of supply as against demand. This is not likely to change materially in the short term.

- Kiwis generally prefer to pursue homeownership for family living and for long term capital gain. Covid is unlikely to change this line of thinking.

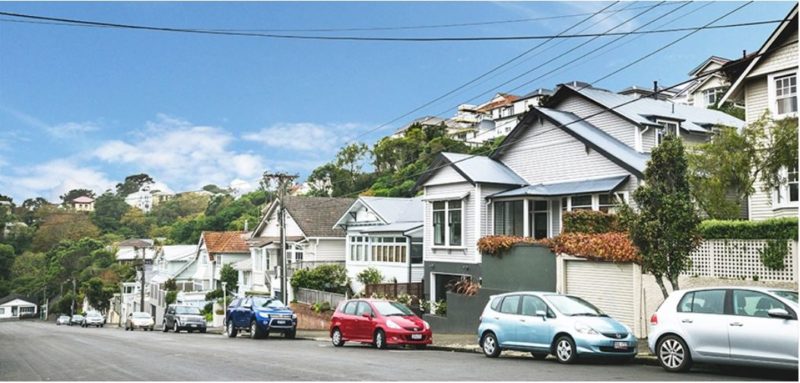

- Never overlook the “Wellington factor.” We live and work in the capital city, a location that draws people nationwide for employment, recreational and educational needs. Our housing market is historically sound and we don’t suffer the market fluctuations of other locations.

Tommy’s remain positive about our housing market and look forward to sharing this positivity with you, the home buyers, and sellers of the future.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal