Wellington Market Update | April 2023

“I think one of the most positive things we have seen over the summer in terms of real estate is the number of first-home buyers that have returned to the market,” Tommy’s Director Nicki Cruickshank says.

“It’s really pleasing to see this group get ‘on the ladder’ and achieve the dream of owning their own home.

“After being locked out over COVID years with extraordinary price rises, the return has been steady.

“After being locked out over COVID years with extraordinary price rises, the return has been steady.

“After a period of ‘sitting on their hands’, families, too, have started to get on with things and are looking to upsize or downsize in what they perceive is a more steady market to do so.”

However, the lack of investors continues to be a weakness of the market that has worrying implications beyond property values and high rents, Nicki says,

“There has been virtually no activity in this part of the market, and for a city that prides itself on our universities and the students we attract here, it is a real concern going forward where they are going to live.

“I know there has been a trend for students to go south to Christchurch or Dunedin in the last year because it is cheaper and easier to get accommodation.

“We have been fortunate in the past couple of years to have a number of townhouses introduced to the market by developers, which has increased the rental pool, but this has come to a screaming halt now.”

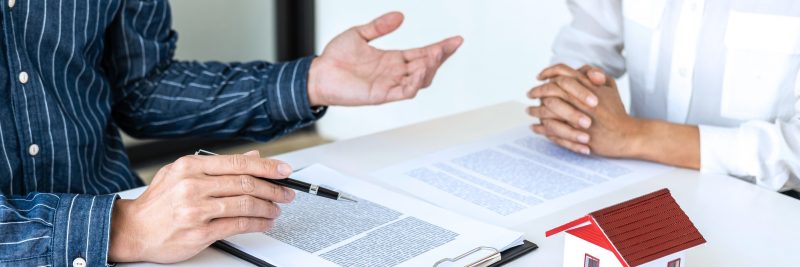

While new government policies, including the removal of tax deductibility on the interest landlords used to be able to claim, have been one factor, another is rising mortgage rates.

Just this month Reserve Bank this month hiked the Official Cash Rate by 50 basis points to 5.25 per cent.

“The latest OCR rise was a bit of a shock to the market as most commentators, and indeed real estate professionals, thought we were at the top of the interest rate cycle,” Nicki says.

“It has probably delayed the peak by a few months. But I still feel that with the competition between banks and the real lack of activity over the last year, interest rates will start to come down by the end of the year.”

Nicki says higher interest rates notwithstanding, it’s still a great time to buy — and that includes not just first-time buyers but also those selling their own home to buy another.

“If you are buying and selling in the same market, it is all about the ‘difference’ and the size of the difference should be a lot less than in a hot market.

“So although the interest rates are a bit higher, when they come back down you will be better off.

“This is certainly the time of the cycle to ‘buy’ as you have a lot less competition and can make offers with conditions, which gives you a lot more time to make sure you are happy with your decision.

“We are likely to experience a flat market in Wellington for quite some time if we are to experience similar cycles to previous years.

“So it’s time to just get on with it, and if you have made the decision to move, then just ‘do it’ – you won’t regret it in the long term.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal