In previous posts on our blog, we have often referred to the real estate market as being cyclical. There have been periods of market buoyancy followed by times when the heat has gone out of the market for any number of reasons; buyer demand has slumped, there is political uncertainty, interest rates are rising, there is employment uncertainty or for a number of other factors. Despite these market fluctuations the market has shown resilience and over the years has produced a steady increase in values. In recent times of course, increases in property values have been spectacular. But what does the future, and in particular 2022, hold for property owners, potential homeowners and for home-sellers?

We would be naïve to think that the escalation of house prices we have witnessed in recent years could continue unabated; there must be a time once again when market forces apply the brakes to our heated market. We are not suggesting for a minute that there is an expectation of a dramatic market collapse and neither do we expect pricing levels to drop significantly. We do see some easing in demand and buyer competition though, so let us cover some of the market indicators we are observing and what they may mean to home buyers and sellers.

OPEN HOMES: Open homes continue to provide most potential buyers with their initial introduction to the real estate market. Buyers can view properties at their leisure, formulate their own ideas as to what is a fair market price and enter into client/agent discussions if further information is required. Open homes also give buyers an opportunity to discuss their personal plans and objectives with the hosting agent. From an agent’s perspective the first priority is to identify potential buyers for the property, but open home attendances are also a good market barometer for assessing buyer interest. Public attendances at late November early December open homes appear to have declined a little which may be an important trend and a sign of the times.

MULTIPLE OFFERS AND NEGOTIATING A SALE: Multiple offers have been commonplace for many of the homes we have sold in recent times, but these situations have become less frequent. Competition leads to higher prices and adds an edge to negotiations so when there is only a single offer on a property, negotiations become more difficult. If this trend persists, agent selection will become even more important as having a proven negotiator working for you when selling will be important. Tommy’s staff training places significant importance on developing their agents negotiating skills.

INTEREST RATES: In recent years, homeowners have enjoyed historically low mortgage interest rates, but for how much longer? At each of the last two reviews of the Official Cash Rate (OCR), the Reserve Bank of New Zealand has increased the rate marginally by 0.25% and this has already been reflected in an upward movement in mortgage interest rates. The OCR is reviewed seven times a year and indications are that further increases are likely next year. While the increases so far will not impact too severely on borrowers, it is a trend that will be observed closely by mortgagors and may discourage some potential home buyers from entering the market.

LENDING INSTITUTIONS: There is no doubt that mortgage lenders have tightened the purse strings, and obtaining finance has become a little more difficult. More questions are being asked about a borrower’s income and ability to service their debt, what other living expenses they may have and their personal situation surrounding health and ability long term to meet their commitments. Tommy’s strongly encourage buyers to use the services of a reputable mortgage broker in locating the best possible terms and conditions for their long-term borrowing. Tommy’s would be pleased to arrange a ‘no obligation’ appointment for home buyers with our associate mortgage brokering company “Moneybox” to assist with finance issues.

TIME TAKEN TO SELL: We have become accustomed to a quick turnover of properties, but this may not always be the case! If there is any market slow down, agents will require a little more time to market and sell your property. There was a time when 90- or 120-days agency periods were commonly suggested by agents but a compromise of say 60 days seems to be an appropriate time going forward. Home sellers may also need to allow a little more time when relocating and taking possession of their next home if the market should tighten in the new year.

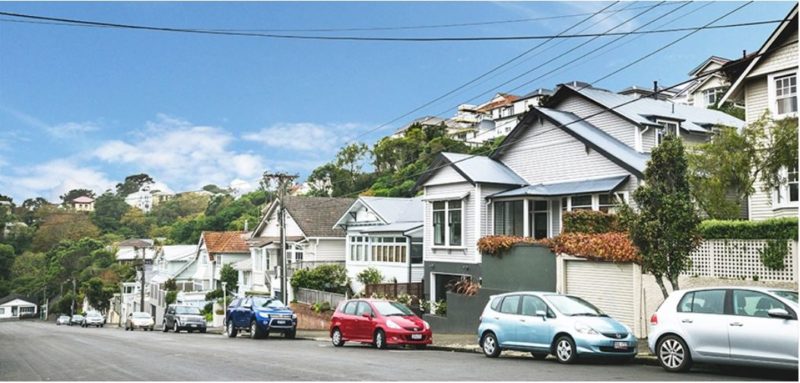

Whilst the tone of this article may sound a little negative, that is not the intention. The intention is simply to consider some of the early indicators that tell us that maybe the market will be a bit more subdued next year. We still live and work in a location where real estate is in keen demand and there continues to be a shortage of available property to meet that demand. The NZ psyche still favours homeownership for most people over renting, and that seems unlikely to change unless pricing becomes prohibitive – which is happening already for some people.

Whilst the curse of Covid has impacted hugely on our lives, it has had only minimal impact on residential housing activity. As an industry we have adapted to Government demands and found new ways of transacting business. We will continue to do so with the safety of our staff and our clients paramount at all times. It may be a little quieter next year, but Wellington real estate will remain in demand and continue to be a sound investment for future financial security.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal