If the events of the past year or so have proved one thing, then that must surely be the resilience shown by the average Kiwi. Covid has thrown us a series of curve balls that have tested our fortitude and required us to adapt to the varying rules that go hand-in-hand with changes from one Covid level to another. By and large though, we have adapted well and accepted that there will be some ongoing demands on what we can and cannot do, possibly influencing our freedom of movement. Whilst the position appears stable today, Covid will remain part of our lives for some time yet!

As if Covid alone has not been enough to contend with, we have also had a timely warning that earthquakes are part of our landscape and are a phenomenon that we must live with. Quite rightly, parts of NZ were recently under instruction to move to higher ground as a precaution against a possible tsunami, which thankfully did not eventuate. It’s a scary thought though that an 8.1 strength earthquake could strike only about 1000 km or so from NZ, and it is another reminder that we need to be as prepared as we can be for a similar eventuality closer to home.

Putting aside pandemics and earthquakes for a moment, Tommy’s as local leaders in the real estate industry see another looming life-changer for the average Kiwi – their ability to own a home of their own. Whilst the rapid escalation in residential housing prices is music to the ears of existing homeowners, Tommy’s has a real concern and sympathy for those who are struggling to get onto the first rung of the homeownership ladder.

Even the most diligent savers are having difficulty in saving for a deposit at a rate that is commensurate with the galloping market. It must be somewhat deflating to realise that the market is moving at a rate that is faster than it is possible to save. Mortgage brokers and lending institutions have stated that of every four or five finance pre-approvals they arrange, it is likely that only one or two are able to locate an affordable property and then submit an offer that is competitive.

Tommy’s has always advocated that a first home buyer in particular, should seek advice and carry out a ‘due diligence’ programme before committing to buy a home. This may include having a valuation completed, or perhaps a building report, and of course arranging sufficient finance. We stand by this belief even though it can be costly and time consuming. Sadly, we see many instances where buyers have carried out some form of due diligence all to no avail and are then out of pocket and needing to divert funds saved for deposit monies.

The other risk factor is that a combination of low interest rates, a low supply of suitably priced houses and a fear of missing out is compounding the price escalation, which enhances the chance of buyers over committing.

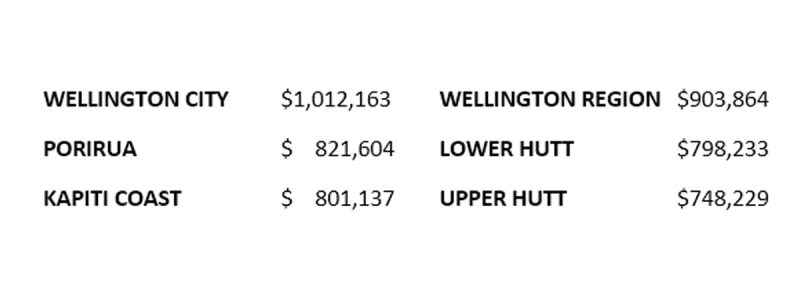

The Dominion Post of 3rd March confirmed what we already knew; property values in Wellington City have exceeded the $1 million mark and that the rest of the region isn’t too far behind as can be seen below:

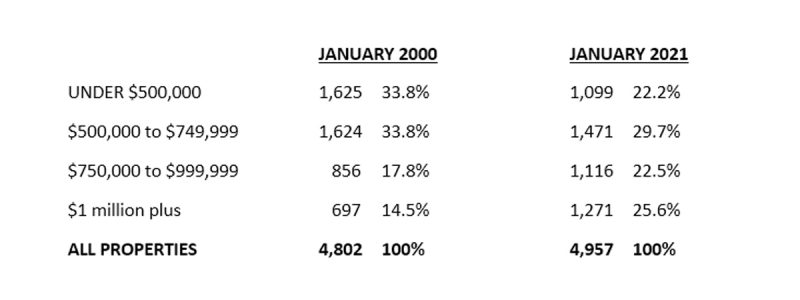

There was a time not too long ago when sales over a million dollars were a rarity. This is no longer the case as can be shown in the figures below supplied by the Real Estate Institute of NZ Ltd.

Whilst the price escalation has benefitted many, our thoughts do go to those suffering under the ‘price pandemic’. We invite you to talk to a Tommy’s agent and we will do our best to assist. There are a number of new-build projects in the planning stage, usually requiring a 10% deposit with the balance of the purchase price payable on completion, which is usually one to two years away. Agreements of this nature offer a fixed price and further time to save. We invite your call for further information.

Whilst the price escalation has benefitted many, our thoughts do go to those suffering under the ‘price pandemic’. We invite you to talk to a Tommy’s agent and we will do our best to assist. There are a number of new-build projects in the planning stage, usually requiring a 10% deposit with the balance of the purchase price payable on completion, which is usually one to two years away. Agreements of this nature offer a fixed price and further time to save. We invite your call for further information.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal