If we learned nothing else last year, we certainly learned how to adapt our customary business practises to accommodate the ever-present threat of Covid-19. The entire business community has had to abide by stringent rules to protect both clients and staff from the spread of Covid – a responsibility that we have accepted, and we have played our part in holding the virus at bay – at least in the short term! We have adapted our standard practices to ensure that properties for sale still receive good marketing exposure and that sale and purchase agreements are able to be negotiated in a safe and secure manner.

We would have hoped that in 2022 we could have put all this Covid intervention in the past and resumed a more normal life but alas, that has not been the case as we adapt yet again. This time to the red-light setting. From our perspective, this will mean minimal change to what has become the standard practise of mask wearing, physical distancing and QR Scanning – all of which require the support of customers and clients, who we know we can depend on. The main change under the red-light setting is the limitations placed on gatherings of over one-hundred people, and this will have negligible impact on the Real Estate Industry.

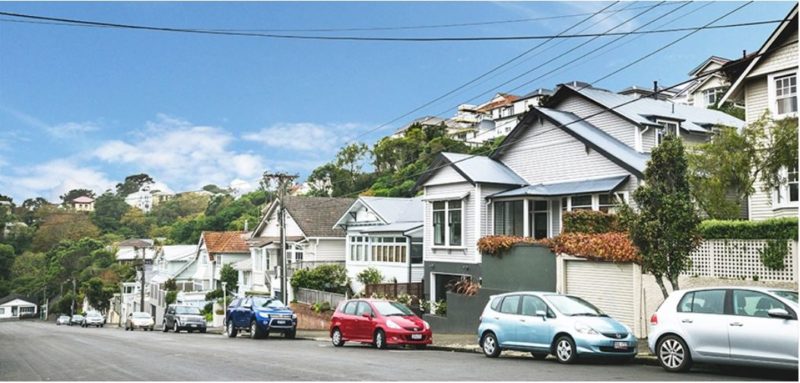

The latest report on the residential property market, released by the Real Estate Institute of NZ (REINZ) on 18th January confirmed what we already knew; that there were record rises in house prices during 2021. The article stated Wellington district median prices had increased 24.2% annually from $805,035 to $1,000,000. Hardly surprising, but that press release was tempered by the suggestion change was in the air.

To quote from the REINZ newsletter, “We are noting signs of deceleration in annual price growth compared to previous months. While the market remains confident, the impact of rising interest rates, tighter lending criteria and changes to investor taxation restrictions are starting to shift dynamics. In particular, the amendment to the Credit Contract and Consumer Finance Act on 1st December 2021 which requires stricter scrutiny of borrower’s financial health seems to have had an immediate effect. Feedback from several regions notes a falloff in buyer numbers as a result.”

Tommy’s observations are somewhat similar to the above comments from the REINZ, and we offer the following additional comments to consider:

- There is already ample evidence that there has been a significant tightening of mortgage finance availability from the major banks, and this will no doubt apply to second tier lenders also. This will place greater pressure on first home buyers to accumulate a larger deposit. Loan applicants are coming under greater scrutiny regarding their income levels and previous spending and saving history. Family assistance and the bank of Mum and Dad will likely take on greater importance in 2022!

- There is more available property on the market than was the case in the latter part of 2021. This gives buyers greater selection but together with other factors takes some heat out of the market and is likely to lessen last year’s intense competition and slow the market down somewhat. Marketing website realestate.co.nz recorded 30% more houses on the market in December than there had been a year before. This percentage is likely to have increased further in January though actual figures were not available when this article was prepared.

- There are a number of apartment blocks under construction and due for completion this year. Although many of these are pre-sold from plans and specifications, inevitably some will come back on the market and will assist in levelling the supply versus demand equation.

- We observe that in some areas, Land Information Memorandum (LIM) Reports are taking up to three weeks to issue. Most property purchasers or their solicitors involve a LIM report as part of their pre-purchase due diligence requirements so buyers and sellers should be aware that a little extra time may be needed to fulfil this often-included condition.

- On January 26th, a Dominion Post article attributed to Corelogic stated that roughly 60% of existing home loans will need to be refinanced in the coming year and for many borrowers this could mean a doubling of their borrowing costs and may also deter new borrowers from participating in the housing market.

In summary, Tommy’s don’t foresee a major reduction in housing prices, but a combination of the above factors combined with an absence of immigrant numbers seems sure to lessen demand and certainly to put the brakes on what has been an explosive market. Selling a home may take a little longer so this should be taken into account when planning your next move. Homeowners and buyers should be comforted though by the fact that Wellington and its environs remain a popular destination and this is unlikely to change.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal