Most will agree that in past years, a majority of Kiwis had a strong desire to own their own home. It has been suggested that homeownership is in our DNA; a house and a quarter acre section was once the target for most aspiring homeowners. Then, perhaps a decade or two ago, there was a growing trend towards rental accommodation becoming a popular option thereby leaving capital free for recreational uses, travel and the purchase of items of personal enjoyment. There was even a body of opinion that suggested renting, based on financial and economic grounds, was a sound option; that capital was best used for funding a business or to pursue some other revenue earning avenue.

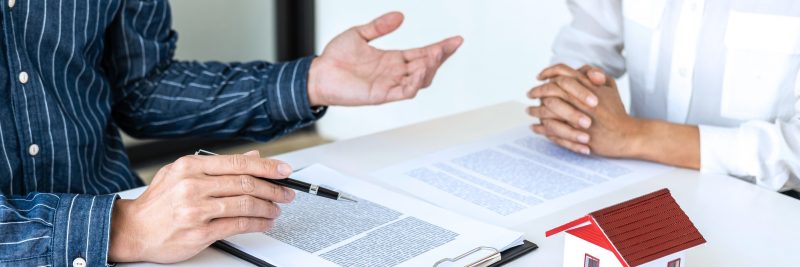

Having looked briefly at the past, is there any consistent pattern that is noticeable in today’s market? The answer is clouded; there are varying opinions among people in the market today looking to house themselves and their dependents. It is no secret that in and around Wellington demand for rental property exceeds supply and this has been the catalyst for soaring rental rates and in fact, establishing an all-time rental high for the capital city and suburbs. There was a well-publicised case recently of a young family who abandoned the renting option and moved to a provincial centre where they were able to purchase a home with lower outgoings than they had previously paid in rent money. Surely a move that makes a lot of sense! Of course before moving out of the city there are other considerations to ponder such as employment commitments and opportunities, and recreational and educational opportunities that may be a factor in the lives of the breadwinner and their family. Tommy’s obviously has a vested interest in people buying and selling property, but we also run a successful rental and property management division. At the risk of being accused of having a biased opinion, we offer the following suggestions all of which we believe are compelling reasons to consider homeownership:

- Whilst high rents are attracting some investors into the market, an equal number are selling their investment properties tired of ongoing legislative demands. This pattern, if it continues is likely to send rental rates to further peak levels.

- Tommy’s has assisted thousands of clients to achieve significant capital gains in recent years. As long as home buying is viewed as being a medium to long term strategy, we feel confident that future capital gains are likely to accrue to homeowners.

- Owning your own home gives security of tenure. You decide if and when you want to move and you are not in the hands of a landlord whose circumstances may change at short notice.

- Homeowners have the scope to make alterations, modernise or replace an outdated kitchen or bathroom and to generally make the house a home.

- Retirement security. Having a roof over your head that is yours is comforting in retirement. This is a time of life when income is usually limited but it is also a time when you will reap the rewards of previous years of planning and sacrificing. The situation of being “asset rich but cash poor” can be overcome by taking a reverse mortgage in those twilight years. This isnot an option favoured by everyone but it is a viable solution to a cash crisis or to fund a travel experience.

- No one wants a mortgage but for most of us, a mortgage is a means to an end. Look at your mortgage as being a compulsory savings scheme. After all, isn’t it better to be reducing your own mortgage than your landlord’s mortgage?

We have said it before and we say it again: we doubt that there is a better place to invest in residential real estate than in Wellington City and suburbs. We may not have the highs and lows of other centres but we do have a consistent market that has new buyers moving to and through Wellington for employment and educational opportunities. Our prices are relatively stable and demand strong. We also have a team of qualified agents at our various Tommy’s offices who await the opportunity to share their expertise and local knowledge with you. Buying, selling or renting, we invite you to give us a call.