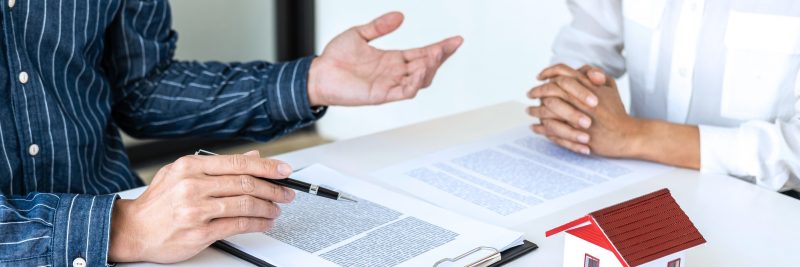

For a number of years now, the majority of property transactions in New Zealand have been consummated on a standard Sale & Purchase Agreement; a legal and binding document that is approved by the Real Estate Institute of New Zealand (REINZ) and the Auckland District Law Society Incorporated (ADLS). The agreement is in a format that will be familiar to many but is still one that we believe should be scrutinised by both a buyer’s and a seller’s solicitor before a property transaction is declared as unconditional. Some solicitors will approve the agreement form in its entirety while others may recommend amendments or the addition of other clauses and conditions they consider appropriate to a particular transaction.

The ADLS/REINZ agreement is regularly updated to move with changing legislation and business practice, and the latest and tenth edition was finalised and released to the public in late November 2019. Real estate education is an ongoing requirement for everyone working in the industry and is equally as important for home buyers and home sellers, especially as they participate in the business of buying or selling a home for the first time. With the onset of another year, we will be dealing with new people and for some it will be their first ever experience with this legal document and for the majority, it will be their first encounter with the new 10th edition. We urge people to familiarise and educate themselves with the changes to the latest edition of the Sale & Purchase Agreement.

Whilst many of the amendments to the 10th edition may be of a minor nature, there is one that all buyers and sellers should know about and understand the implications of. To quote, “The Real Estate Institute of NZ says changes to finance condition clauses in the 10th edition of the REINZ/ADLS Inc Agreement for Sale and Purchase mean purchasers will be required to provide evidence if they can’t raise finance.

REINZ says under the previous edition, if a finance condition is inserted into a sale and purchase agreement and the purchaser cannot obtain finance, their word was generally good enough for an individual to pull out of a contract. However, REINZ says, under the changes to the finance condition purchasers will now be required to provide evidence if they can’t raise finance. Evidence might include a letter or email from the purchaser’s bank confirming that finance has been declined. This is a significant change to the Sale and Purchase Agreement and it’s imperative that consumers understand the implications as if they can’t provide evidence they can’t raise the finance, they could be forced to proceed with the purchase or face other legal action by the vendor, says REINZ Chief Executive Bindi Norwell.”

There is no doubt that over the years, the finance clause has been misused by people who have had a change of mind or who have decided against buying a property they had contracted to buy. There can be any number of reasons for wanting to withdraw from a purchasing commitment such as buying on impulse and then having regrets, over committing, change of personal or family circumstances, locating a more suitable property or simply getting ‘cold feet’ at the thought of making a significant financial commitment to buy.

Buyers should be fully aware it will no longer be a simple matter to withdraw from a contract on the basis of an inability to raise finance unless there is a genuine reason supported by documentary evidence. This is yet another good reason why anyone looking to purchase a property should seek legal advice and talk to their finance provider so that they understand exactly what they’re signing, as the implications are significant.

However, on the more positive side of real estate, there will be many who do want to purchase a home in 2020, they will do their homework, they will understand the implications of their contractual liability on signing an Agreement for Sale & Purchase and the Tommy’s sale team will endeavour to find the best possible property to meet their present and future requirements.

Our belief is that it is never too early to start planning for life after retirement. Make 2020 the year that you purchase your first home or perhaps an investment property.

We have assisted many home buyers in taking that first step towards long term financial security and it is satisfying from our point of view to see their investments flourish over the last two decades that Tommy’s has been selling real estate in and around Wellington. It is a new year, but Tommy’s are here with a proven track record, marketing systems in place that work and a burning desire to assist the next wave of home buyers making Wellington their home base. We invite you to call us at any time.